Retirement Planning

Your best retirement starts with a great plan. No matter where you are on your journey, the perfect time to start planning for retirement is now. The sooner you start saving for retirement, the more time your money has to grow.

So, how can a financial planner help you make real financial progress on the road to retirement? For starters, by taking a holistic look at your goals and setting up a personalized strategy to help you achieve them.

- Set your retirement goals

- Maximize your savings and investments

- Learn how to manage spending in retirement

Can you afford to retire?

How much money will you actually need? Does your current investment strategy line up with your goals? You might be surprised!Use our calculator to find out if you're on the road to the retirement you want and get advice on how to make the most of your money.

Retirement savings calculatorPaint your retirement picture

A beachfront property? Travelling the world? Catching up on your reading? Whatever your dream retirement looks like, we’ll help you find the right way to get there.

Your retirement plan should be as unique as you are. From deciding on whether to continue to work to figuring out where you want to live, you need to use the right approach.

Get in touch with a financial plannerThe working years

Retirement has a way of sneaking up on you. Start preparing well in advance by taking advantage of all the resources at your disposal.Make the most of your unused RRSP room

Now’s the time to make use of that unused room! You’re probably in a higher tax bracket now than you were when you were starting out so benefit from those RRSP contributions while you can.Open a spousal RRSP

Level the playing field with a spousal RRSP. As a couple, you’ll pay less tax in retirement if your incomes are relatively equal which can lead to big savings down the road.Assess your appetite for risk

Is your investment approach in line with your goals? Don’t wait to find out. Let’s fine-tune your investment strategy to maximize returns without taking on undue risk.

Living in retirement

Even the best retirement plans need the occasional adjustment. As you enjoy this new chapter of your life, make sure that your money keeps doing what it’s supposed to do.

You’re allowed to change your mind, change your goals or change your plan entirely. A financial planner can help keep your money working hard for you, no matter where retirement takes you.

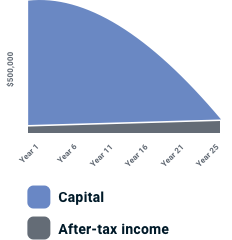

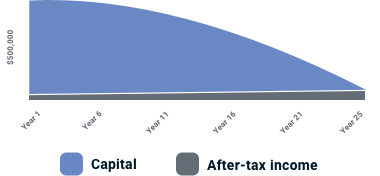

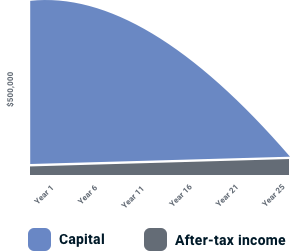

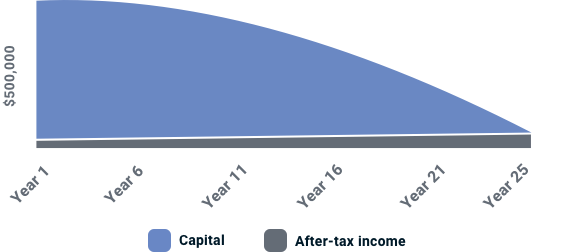

How will your investments work for you?

Retirement is just around the corner. Time to find out how much your investments could earn you. Learn about how different payout options could impact your income and get tips on how to best adjust your investment strategy to prepare for your next step with our Investment Payout Calculator.

Meet , a financial planner near you

Helpful resources for your homebuying journey

Are you ready for the mortgage stress test?

Find out how getting pre-approved can help you reach your goals faster.

Find out how getting pre-approved can help you reach your goals faster.

Get in touch

We'll be in touch

Just answer a few questions to request a call or email from a financial planner.

Let's connect remotely

Get in touch with a Virtual Financial Planner without leaving your home.